How can we find investments that are going to last, make money and do good things for the planet? When I started learning about investing in mutual funds holding a diversified collection of stocks it became apparent that many funds held companies I did not like including makers of tobacco or guns. These mutual funds made good returns. However, when I looked for mutual funds that advertised being socially conscious many performed below market expectations.

I make no claims of providing advice beyond sharing my personal experience. One of the first sustainability mutual funds that I heard about was Pax World. Their website states:

“Established in 1971, Pax World is a recognized leader in sustainable investing. The Pax World sustainable investing approach fully integrates analysis of macroeconomic and market trends, fundamental security-specific financial data, environmental, social and governance (ESG) factors, and disciplined portfolio strategies.”

There is a trend for many corporations to consider sustainability but there is a paradox. Cambridge Dictionary defines a paradox as, “a situation or statement that seems impossible or is difficult to understand because it contains two opposite facts or characteristics.” Will investing in ESG funds make good returns and be an incentive for the non-ESG companies to go out of business? In 2018, I wrote a blog on ESG investing when BlackRock endorsed the trend to be more competitive.

As consumers and investors we can vote with our money to choose companies that do more good than harm. Most importantly, we need transparency and experience to be informed in what we are buying. I like to checkout each stock’s fundamentals held in the mutual fund or ETF with information available on the internet such as in Yahoo Finance.

Checking out the top 10 holdings for several mutual funds listed as being “sustainable” they include many of the same S&P 500 tech companies, home builders, and banks. So sustainability is focused on the company’s behavior more than saying it is immune to bubbles and crashes.

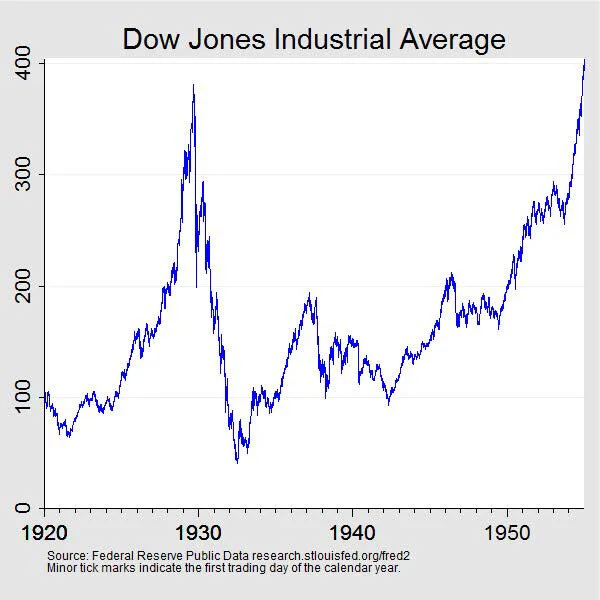

Embedded in my DNA is a fear of another stock market crash like my parents lived through in 1929. I wonder how many people have this phobia as well? Fear, consumer confidence, and Fed intervention have a big influence on stock and bond markets.

What caused the crash? According to Economics.help:

“The 1929 stock market crash was a result of an unsustainable boom in share prices in the preceding years. The boom in share prices was caused by the irrational exuberance of investors, buying shares on the margin, and over-confidence in the sustainability of economic growth. Some economists argue the boom was also facilitated by ‘loose money’ with US interest rates kept low in the mid-1920s.”

The current U.S. stock market boom over the past decade is being compared to the 1920’s and 1960’s by many experts. Will ESG green investments survive a market meltdown? Probably not. According to a former Blackrock executive in charge of sustainable investments as interviewed in The Guardian, corporations are focused on maximizing shareholder value. Unless there are economic incentives such as a carbon tax imposed by the government, it is unlikely ESG funds will be successful. So consider carefully the “green-washing” of ESG and sustainable investing to realize there is a lot of slick marketing, maybe even smoke and mirrors, with the mutual fund industry. Please comment below to share your opinion.